Hi everyone,

I am taking 2 weeks off in Canada. I will return on April 1st and resume my posts in that week. I have closed out all trades (except EURUSD) today because I am not trading whilst travelling. Here are updates to trades that I have entered or exited since Monday 9th March.

AUDUSD

Price retraced to 0.7740 resistance as I had wanted and I switched down to 1 hour chart to observe price action closely. Resistance was tested twice and after seeing that the second attempt was weaker than the first I decided to short at 0.7710 with -30 pips stop placed just above resistance.

Entry @ 0.7710

Stop @ 0.7740 (-30 pips)

TP1 @ 0.7650 (+60 pips) exited 80% for 2:1 RR

TP2 @ 0.7590 (+120 pips) exited 20% for 4:1 RR

Final RR for the trade is 2.4:1

AUDNZD

The down move came earlier than I had anticipated and I was not able to catch it on any intraday time frames.

EURUSD

I have moved my stop for the remainder 20% of my position to 1.0725 which is the high of the daily candle 11/3/2015. Swap is positive for this short so I don't see why I should close it now given the fact that it could continue to drop.

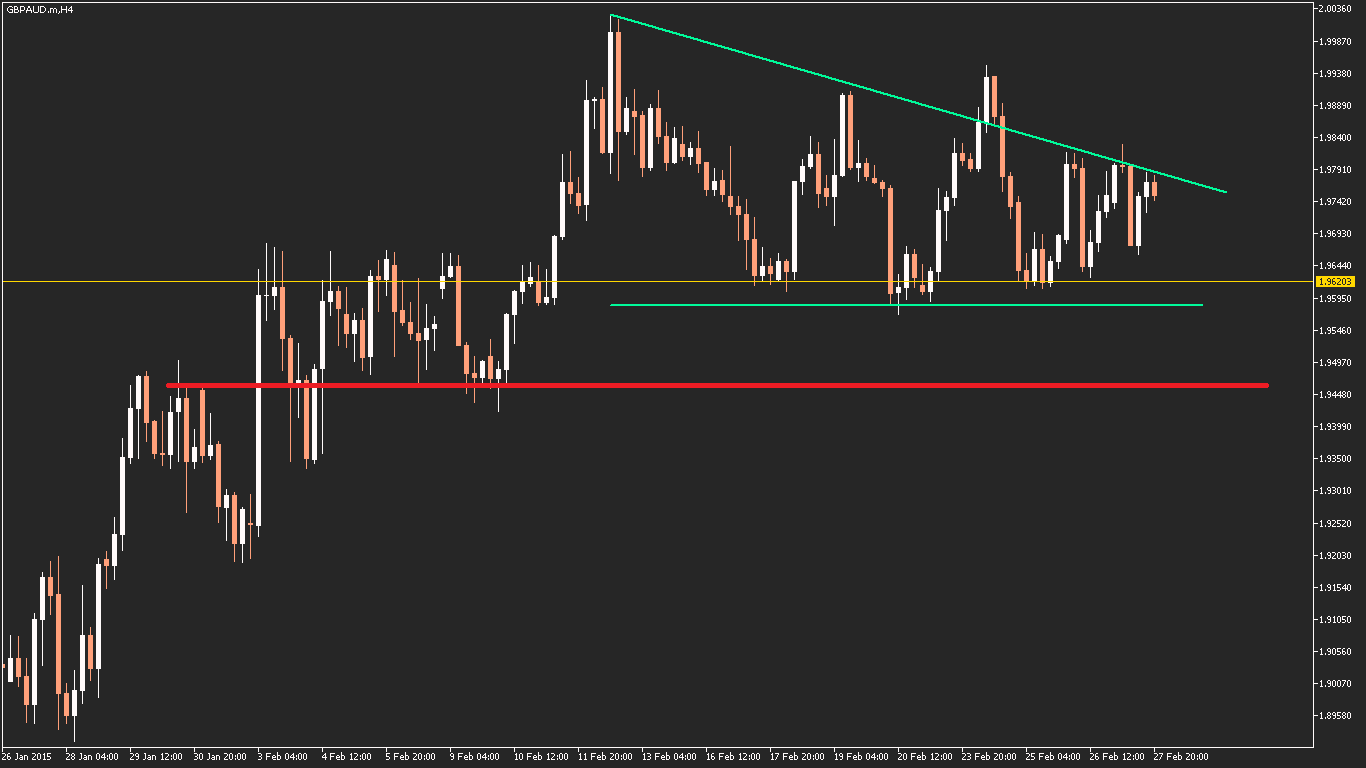

GBPAUD

This pair rallied hard and the remainder 20% of my short has been stopped out at break even.

Overall RR for this trade is 2.4:1 .

GBPJPY

Price has broken through both support lines therefore my prediction of a rally at support is no longer valid.

USDCAD

Last Sunday I mentioned that I was specifically looking for one of the two scenarios to take place before going long. It was scenario B that unfolded and I went long on 4 hour chart after price tested support on 12/3/2015 and price action showed me strong evidence of buying. I entered on the open of the following 4 hour candle.

Entry @ 1.2701

Stop @ 1.2614 (-87 pips)

TP1 @ 1.2795 (+94 pips)

I closed the trade today for +47 pips. Final RR is 0.54:1

I am taking 2 weeks off in Canada. I will return on April 1st and resume my posts in that week. I have closed out all trades (except EURUSD) today because I am not trading whilst travelling. Here are updates to trades that I have entered or exited since Monday 9th March.

AUDUSD

Price retraced to 0.7740 resistance as I had wanted and I switched down to 1 hour chart to observe price action closely. Resistance was tested twice and after seeing that the second attempt was weaker than the first I decided to short at 0.7710 with -30 pips stop placed just above resistance.

Entry @ 0.7710

Stop @ 0.7740 (-30 pips)

TP1 @ 0.7650 (+60 pips) exited 80% for 2:1 RR

TP2 @ 0.7590 (+120 pips) exited 20% for 4:1 RR

Final RR for the trade is 2.4:1

AUDNZD

The down move came earlier than I had anticipated and I was not able to catch it on any intraday time frames.

EURUSD

I have moved my stop for the remainder 20% of my position to 1.0725 which is the high of the daily candle 11/3/2015. Swap is positive for this short so I don't see why I should close it now given the fact that it could continue to drop.

GBPAUD

This pair rallied hard and the remainder 20% of my short has been stopped out at break even.

Entry @ 1.9590

Stop @ 1.9630 (-40 pips) moved to break even

TP1 @ 1.9470 (+120 pips) exited 80% for RR of 3:1

TP2 @ 1.9350 (+240 pips)

GBPJPY

Price has broken through both support lines therefore my prediction of a rally at support is no longer valid.

USDCAD

Last Sunday I mentioned that I was specifically looking for one of the two scenarios to take place before going long. It was scenario B that unfolded and I went long on 4 hour chart after price tested support on 12/3/2015 and price action showed me strong evidence of buying. I entered on the open of the following 4 hour candle.

Entry @ 1.2701

Stop @ 1.2614 (-87 pips)

TP1 @ 1.2795 (+94 pips)

I closed the trade today for +47 pips. Final RR is 0.54:1